Entrepreneurs face an uphill battle when attempting to raise capital to grow their business. The reality is that the probability of raising “risk capital” – namely venture or angel capital – is very low for most startups. Some of the common reasons companies don’t qualify include:

- Not in a high-enough-growth technology sector

- Product isn’t new or disruptive to the status quo

- Gross margin is less than ~50%

- Addressable market is too small (< $500M – $1B)

- Too many direct competitors that are much further along

If any of these describe your company, then angel and venture capital (“VC”) probably isn’t for you. Even companies meeting all these criteria have a low probability of success raising risk capital. But don’t worry. Many of the most successful tech companies never raised a dime of venture capital, even ones that could have, like Dell, GoPro, and Medtronic. Most great companies bootstrap their way, and that may be the best path for your company as well. All the time and energy you planned to spend fundraising (and it takes a lot of both) can instead be spent landing customers and growing the business.

That being said, if you think raising angel/venture capital is the right path for your startup — and for some it is — then you need to educate yourself. There are many good books that cover fundraising in detail. My personal favorite is Raising Venture Capital for the Serious Entrepreneur. And while you need to read up on the topic, you’re time is limited.

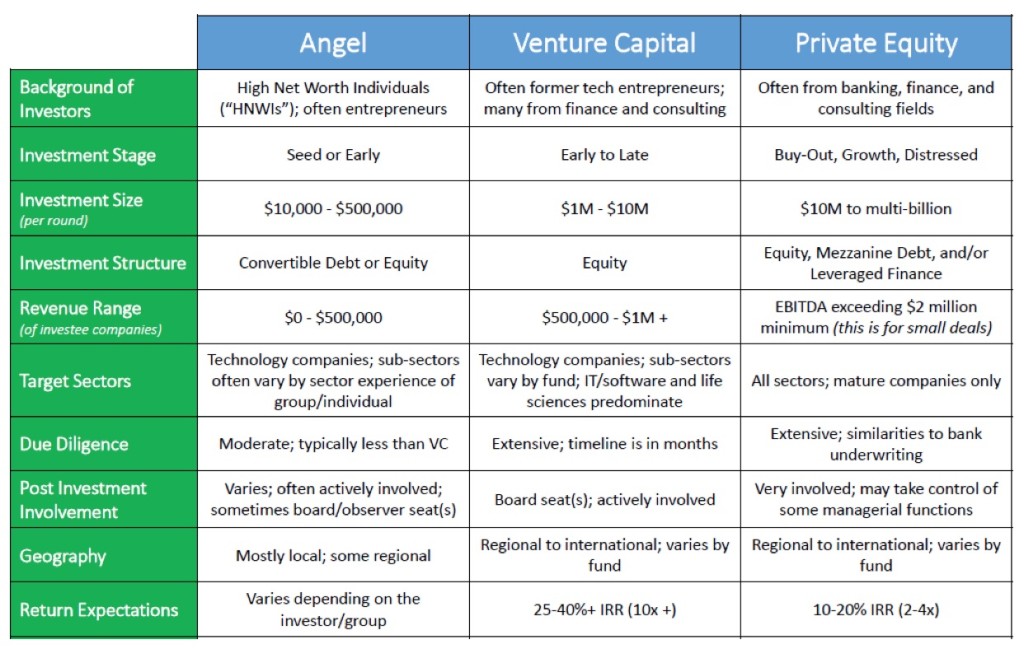

With that in mind, below is a brief table on funding sources to help get you started. It compares angel, venture capital, and private equity, the last of which was included only because it’s sometimes confused as a form of startup capital. This usually stems from the fact that “private equity”, as a general term, can be used to describe all capital sources that aren’t part of the publicly traded equity markets, including angel and VC. But for those in the industry, private equity usually refers to private equity funds (“PE funds”), which is its own separate class of investor that should be taken off your list as a startup.

An important takeaway from the table is that these capital sources have structured approaches and consistently stick to their investing models. As an entrepreneur then, it’s important to identify those capital sources that fit your stage, sector, capital need, timeframe, return projections, and geography. You can do most of that research by simply checking out their websites. If you don’t do the research, you’ll end up wasting a lot of time and potentially losing some credibility with investors in the process.

Another takeaway, for companies trying to raise angel capital specifically, is that there can be more variability in return expectations and investor involvement than VCs, depending on the individual or group. For some angels, returns aren’t the only goal. Some also invest to help their community and have a social impact in some way, in addition to financial gain. These people aren’t advertising themselves, however, so you’ll have to be a savvy networker to find them and gain their interest. As is often the case, it’s partly who you know.

Michigan has a growing entrepreneurial ecosystem to help your company get started and navigate many of the challenges you’ll face, including fundraising. I highly recommend you take the time and leverage these resources, most of which are publicly funded (and therefore free), including:

- Ann Arbor SPARK – for companies based in the greater Ann Arbor region

- Michigan’s SmartZones – for companies based elsewhere in Michigan

- Michigan SBDC – Tech Team

- Michigan Venture Capital Association (MVCA)

- Michigan Economic Development Corporation (MEDC)

The Michigan Angel Fund, which is affiliated with Ann Arbor SPARK, is a hybrid angel group and fund with over 120 members that invests in seed and early stage tech companies based in Michigan. In particular, we’re looking for disruptive companies with relatively low capital needs, where subsequent venture funding is typically not needed. The Michigan Angel Fund just closed its third fund (“MAF III”), and is now investing. We’re excited to announce our first two investments in Groundspeed and Court Innovations, which are both exemplary Michigan companies. Visit the Michigan Angel Fund website for more information and contact me directly (mike@annarborusa.org) if you think your business might be eligible for investment.

By Mike Flanagan, Director at Ann Arbor SPARK & the Michigan Angel Fund

Source: SPARK