It’s a brand new year. Along with all the end of 2016 “wrap ups” is Swisher’s 2016 Year-End Vacancy Report, released January 6th. Swisher has been doing this analysis since 2003, and it remains the most comprehensive snapshot of commercial real estate vacancy in Ann Arbor.

Here are some of my main takeaways, a few of the best visuals from the report, and Swisher’s headlines. The full report is available here.

My main takeaways:

- Overall, demand for office lease is growing (up 10% from 2015).

- Downtown vacancy rates are still very low, but have held steady at 2.1%, while the North Office Area’s vacancy rate is decreasing.

- The change in vacancy rates (increase or decrease) in South Office, South Flex, and West Office Areas are mostly due to one or two large buildings either becoming vacant or being sold/leased. The majority of space in these areas remains stable. The change in % can therefore be deceiving!

- Prices per square foot are not included in the Swisher report, but vary widely across all sections of the city; not everything is as expensive as downtown.

- The picture painted by the report is one of a healthy commercial real estate market in Ann Arbor, indicating a vital, growing economy.

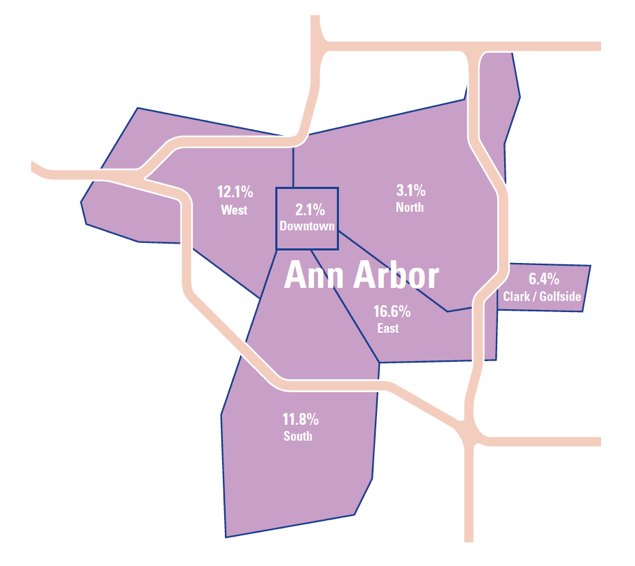

2016 Vacancy Map

2015 Vacancy Map

Trends

2016 Total Market Vacancy Rate for Office and Flex Space

Swisher’s Headlines:

- Swisher Commercial personally surveyed 301 buildings of 5,000 square feet or larger, totaling over 12,000,000 square feet

- Flex vacancy rates have decreased from 12.5% to 6.5% in the past year

- Office vacancy rate increased from 7.1% to 9.4% in the past year

- The Downtown Office Area (DOA) vacancy stayed at the historically low rate of 2.1%

- The North Office Area (NOA) vacancy rate decreased to 3.1% from last year’s 3.5%

- The East Office Area (EOA) vacancy rate decreased to 16.6% from its 2015 rate of 18.7%

- The Clark-Golfside Medical Area (CGMA) Office Area vacancy rate decreased from 7% in 2015 to 6.4% in 2016

- The South Office Area (SOA) had an increase in vacancy rate from 10.3% to 16.2%

- The South Flex Area (SFA) had the largest decrease in vacancy rate this year, moving from 13.1% to a startling 5.6%

- The West Flex Area (WFA) vacancy rate increased from 9.7% to 10.6% this year

- Swisher Commercial’s internal statistics show that the office space leasing demand in 2016 was about 10% stronger than 2015

Source: SPARK